Key Takeaways

- Understanding the standard closing process helps you identify steps you can expedite or delay to fit your schedule.

- Effective communication with all parties involved is crucial for a flexible closing timeline.

- Being prepared with the necessary documentation and financial arrangements can significantly speed up the closing process.

Table of Contents

- Understanding the Standard Closing Timeline

- Steps to Align Closing with Your Schedule

- Potential Challenges and How to Overcome Them

- Benefits of a Flexible Closing Date

- Conclusion

Closing on a home is a pivotal moment, representing the transition from searching to finally settling in. However, managing the closing process to fit your personal timeline requires knowledge, coordination, and foresight. If you want to ensure your real estate closing works for your schedule, understanding each step and communicating proactively are essential. For more guidance on navigating every aspect of a home purchase, visit https://www.readydoorhomes.com/.

The sequence of paperwork, inspections, appraisals, and negotiations can seem complicated, but with careful planning, you can influence nearly every deadline. Timely preparation and open discussion with buyers, sellers, and professionals make all the difference in meeting your goals without surprises. Building flexibility into this process will not only give you peace of mind but could also save you time and money.

Understanding where delays commonly occur, knowing your options for flexibility, and having all documents ready in advance can smooth your path to closing. An adaptable approach lets you address issues quickly while still adhering to your desired timeline.

For a step-by-step outline on managing closing schedules and more, visit readydoorhomes.com.

Understanding the Standard Closing Timeline

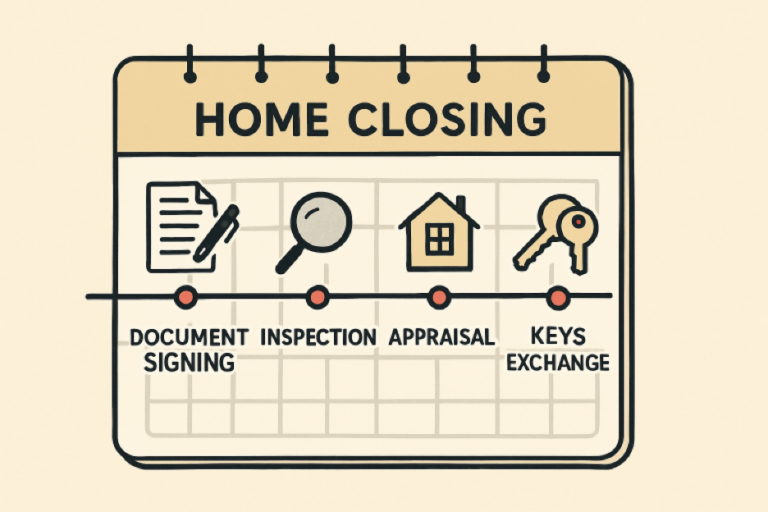

Generally, home closings in the United States last 30 to 45 days after an offer is accepted. This timeline, however, depends on several steps that require coordination between everyone involved in the transaction. Here is what you can expect during a typical closing:

- Signing the Purchase Agreement: The purchase contract is finalized with terms agreed upon by both buyer and seller.

- Home Inspection and Appraisal: Independent parties check the property’s condition and market value. Home inspections are a buyer safeguard, while appraisals ensure the property meets lender standards.

- Mortgage Underwriting: The mortgage lender verifies your financial history, debts, and assets to confirm you can afford the loan amount.

- Title Search and Insurance: This process ensures there are no legal claims against the property and provides insurance to protect ownership rights.

- Final Walkthrough: Usually done a day before closing, buyers ensure the property remains in the agreed-upon condition.

- Knowing which phase is most susceptible to delays helps you identify opportunities to accelerate or adjust timelines to your preferences.

Steps to Align Closing with Your Schedule

Achieving the right closing date for your needs comes down to thoughtful action and open conversation with every professional helping you purchase your home. You can take the following steps to proactively manage the timeline:

- Pre-Approval for Mortgage: Secure a mortgage pre-approval before beginning your search. This not only clarifies your budget but also expedites the underwriting process once you have a signed purchase agreement.

- Prompt Scheduling: Arrange for home inspections and appraisals as soon as the contract is signed. Early scheduling gives you ample time to address issues if they are uncovered.

- Organized Documentation: Maintain a checklist of documents your lender may request, such as pay stubs, tax returns, and proof of assets. Having these at the ready prevents last-minute bottlenecks.

- Clear Communication: Check in regularly with your agent, lender, and the seller’s team. Consistent communication ensures that everyone is aligned on expectations and scheduling.

- Flexible Closing Date: When drafting your purchase agreement, try to negotiate a closing date that aligns with both your preferred timeline and the other party’s availability. Building flexibility into your contract can make last-minute changes less stressful.

Actively managing these areas can help you stay in control and avoid unnecessary delays.

Potential Challenges and How to Overcome Them

Even with every precaution, unexpected challenges may arise that could shift your closing date. Successfully managing these common issues includes preparation and rapid response:

- Delays in Documentation: Clarify deadlines upfront and regularly verify with each party that necessary documents are being prepared and submitted as planned.

- Inspection or Appraisal Issues: If an inspection reveals repairs or an appraisal comes in low, work with your agent and the seller’s team to quickly negotiate solutions or request re-inspections.

- Financing Hurdles: Lender concerns or underwriting issues can arise last minute. Stay available for updates and respond promptly to lender requests. Monitoring your credit and avoiding new debts during this time will also reduce the risk of financing delays.

Benefits of a Flexible Closing Date

Tailoring your closing schedule to fit your specific circumstances offers various advantages. Firstly, it allows for better coordination with moving plans, ensuring that movers and utility transfers occur on a timeline that minimizes stress and prevents gaps in living arrangements. Secondly, it aids financial planning by aligning transactions with bonuses, investment maturities, and other significant financial events, thereby optimizing cash flow. Additionally, setting a closing date that accommodates personal commitments helps navigate life events, such as children’s school schedules or work obligations, making the overall experience more manageable. Overall, a flexible closing date enhances the home-buying process and provides crucial flexibility in the event of unexpected setbacks.

Conclusion

Closing on a home can be as aligned with your personal needs as you make it. By taking charge of each step, maintaining clear communication, and proactively addressing challenges, you can ensure the process aligns with your timeline. Staying organized and flexible not only increases your confidence but also makes the transition into your new home smoother.